What are notes payable? Definition with examples

Content How to record notes payable Examples of note payable What is a note payable? Our Services Notes payable vs accounts payable What is Notes Payable? Finance Strategists is a leading financial literacy non-profit organization priding itself on providing accurate and reliable financial information to millions of readers each year. At Finance Strategists, we partner […]

Content

Finance Strategists is a leading financial literacy non-profit organization priding itself on providing accurate and reliable financial information to millions of readers each year. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. This increases the net liability to $5,150, which represents the $5,000 proceeds from the note plus $150 of interest incurred since the inception of the loan. Therefore, in reality, there is an implied interest rate in this transaction because Ng will be paying $18,735 over the next 3 years for what it could have purchased immediately for $15,000. A problem does arise, however, when an obligation has no stated interest or the interest rate is substantially below the current rate for similar notes. Eliminate manual data entry and create customized dashboards with live data.

John makes an inquiry with Grant’s Capital Co. which agrees to lend money to John’s company. John issues notes payable worth $10,000 which is a promise to payback. Now, every month for the next 3 months, the interest payment will be made to Grant’s Capital. At the end of 3 months, the sum of $10,000 will be returned to Grant’s Capital. Borrowing of money for business needs, mostly short-term, against the issuance of a promissory note, is done through notes payable.

How to record notes payable

Notes payable is usually divided into bank debt and other notes payable. Other notes payable would be any money that you owe to any kind of financier with a long-term repayment plan. In other words, the notes payable definition is that it is any long-term loan you have to repay, whether it is secured or unsecured.

A note payable is created when a company borrows money usually from a bank or financial institution, but some other companies perform their own financing if they are large enough. Accounting treatment for this account depends on whether the note signed is longer than a year i.e. long term debt or short term. Companies sign these notes when they are in need of growth and do not have the cash on hand.

Examples of note payable

Notes due within the next 12 months are considered to be current or short-term liabilities, while notes due after one year are long-term or non-current liabilities. Notes payable are oftentimes confused with accounts payable, and while they are both technically company debt, they https://www.bookstime.com/articles/notes-payable are different categories. We can think of accounts payable as very short-term debts the company might owe as payment for goods or services from another party. They are typically paid off within the span of a month, whereas notes payable could have terms as long as several years.

Notes payable is a liability account written up as part of a company’s general ledger. It’s where borrowers record their written promises to repay lenders. By contrast, the lender would record this same written promise in their notes receivable account. Those kinds of financing deals that will be repaid over a long time are known as notes payable. The bank deposits the funds in your business account, and you are able to purchase the moving truck you need to expand your company.

What is a note payable?

If neither of these amounts can be determined, the note should be recorded at its present value, using an appropriate interest rate for that type of note. Often a company will send a purchase order to a supplier requesting goods. When the supplier delivers the goods it also issues a sales invoice stating the amount and the credit terms such as Due in https://www.bookstime.com/ 30 days. After matching the supplier’s invoice with its purchase order and receiving records, the company will record the amount owed in Accounts Payable. The proper classification of a note payable is of interest from an analyst’s perspective, to see if notes are coming due in the near future; this could indicate an impending liquidity problem.

Notes payable are often used when a business borrows money from a lender like a bank, institution, or individual. Essentially, they’re accounting entries on a balance sheet that show a company owes money to its financiers. If a company borrows money from its bank, the bank will require the company’s officers to sign a formal loan agreement before the bank provides the money.

Our Services

Notes payable include terms agreed upon by both parties—the note’s payee and the note’s issuer—such as the principal, interest, maturity (payable date), and the signature of the issuer. Interest expense is not debited because interest is a function of time. The discount simply represents the total potential interest expense to be incurred if the note remains’ unpaid for the full 120 days.

If the loan due date is within 12 months, it’s considered a short-term liability. Though notes payable includes a written promise to repay what was borrowed (with interest) by a set date, accounts payable includes nothing of the sort. With no written promise, this is perhaps the biggest difference between the two accounts. When you are preparing your business balance sheet, you will list all your current liabilities like credit card debt, accounts payable, and so on.

Notes payable vs accounts payable

Those are short-term liabilities that you usually need to repay monthly. By contrast, recording liabilities in accounts payable doesn’t always take interest into account, nor does it involve formal promissory notes. Instead, you simply enter each individual item on the liability side of the balance sheet. Notes payable is a written promise to pay a certain amount at some future date. The account appears on the balance sheet when the company borrows money and signs a note or contract stating they will repay the amount plus interest.

Tilray’s Stock Just Crashed 21%. Here’s Why It’s a Better Buy Than … – The Motley Fool

Tilray’s Stock Just Crashed 21%. Here’s Why It’s a Better Buy Than ….

Posted: Mon, 05 Jun 2023 11:45:00 GMT [source]

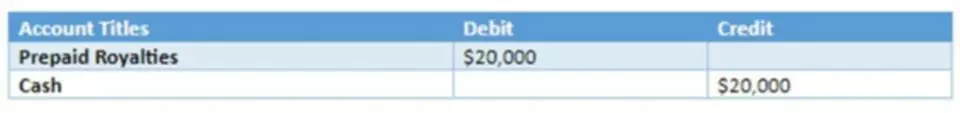

To properly manage either payable category, granular spend visibility is essential. Without it, the benefit of strategic financing can be diminished or even become a vector for financial risk. Debt can be scary when you’re paying off college loans or deciding whether to use credit to… A written agreement between two parties stating that one will pay the other back at a later date. Debit your Notes Payable account and debit your Cash account to show a decrease for paying back the loan.

The principal is just the total payment less the amount allocated to interest. The interest portion is 12% of the note’s carrying value at the beginning of each year. A low interest rate is possible for borrowers with a strong credit and financial profile. A borrower with a weak credit history and a relatively less healthy financial profile may be in for a higher interest rate. While these steps are possible using a manual process, the volume of accounts and invoices in most companies requires automation to fully realize savings and control. Many businesses operate across several sites and via separate departments that replicate similar activities.

Is a notes payable an asset?

A notes payable is a liability account in which a borrower records a written promise to repay a lender. It's often a long-term liability because it's payable beyond 12 months, though many pay it within five years.

Gizem

Gizem 28 Nisan 2023

28 Nisan 2023